In this 2018 second-quarter update, we cover some of the most important tax issues for companies in the technology, communications and media, and life sciences industries and highlight what your organization can do to stay ahead of them.

In this 2018 second-quarter update, we cover some of the most important tax issues for companies in the technology, communications and media, and life sciences industries and highlight what your organization can do to stay ahead of them.

States May Use Economic Nexus

On June 21, 2018, the US Supreme Court overturned South Dakota v. Wayfair, Inc., reversing the long standing physical presence nexus standard for sales and use tax.

States can now potentially use the economic nexus standard established in Wayfair to require remote sellers to begin collecting and remitting sales and use tax, which creates new challenges for remote sellers to navigate. Our Alert has the details.

ASC Topic 606

As companies move forward with their adoption of the Financial Accounting Standards Board’s (FASB) Accounting Standard Codification® (ASC) Topic 606, Revenue from Contracts with Customers, their attention is starting to turn to potential tax issues.

However, they may be unaware that changes enacted by the 2017 tax reform reconciliation act, also known as the Tax Cuts and Jobs Act (TCJA), to Section 451 have changed the tax income recognition for companies with an applicable financial statement (AFS). For example, an audited financial statement.

The most notable change that needs immediate consideration is new Section 451(b), which requires that income is recognized for tax purposes at the earlier of test when the all-events test is satisfied or when the amount is recognized in the taxpayer’s AFS. While this may sound simple, there are many unclear issues. With this change though, companies with accelerated book income from ASC 606 will likely have accelerated tax obligations and need to prepare for the earlier taxes due.

Here are a few common areas where the changes under ASC 606 and the TCJA will change long-standing tax treatment:

- A company may have an agreement with some contingent payments—These contingent payments may not have met the all-events test. However, under ASC 606, these payments may be included in income. Under the revised Section 451(b), it’s possible the contingent payment may be included in income earlier than was previously required.

- Revenue recognition documentation may have projected expenses included in a company’s revenue calculations—The tax deduction for those expenses would be determined under the rules for liabilities, which could result in recognition at a different time.

IRS guidance is expected on how Section 451(b) applies in light of ASC 606. In May of 2018, the IRS published Rev. Proc. 2018-29, providing automatic consent for taxpayers that want to align their tax accounting method for revenue with their new ASC 606 method, though there are some exclusions. Importantly, to be eligible for automatic consent, the change needs to be requested for the same year the company adopts ASC 606.

You can learn more in our Revenue Recognition Guide.

State Tax Implications of Internal Revenue Code Section 965

Tax reform changes to certain foreign earnings, profits, and deductions for federal tax also have state tax implications. Our Insight provides an overview of some issues and state-specific examples. Learn more in our Insight.

Comply with State Laws Using State-by-State Apportionment Schedules

Navigating pass-through entity (PTE) apportionment can be complicated—especially for taxpayers with several sources of revenue, complex operations, and a potentially global reach. Creating apportionment schedules by state can help businesses that own PTEs streamline the process and comply with state apportionment factor laws. Discover how in our white paper.

Section 382 NOL Limitations

At a high level, the calculation of a Section 382 limitation is generally a two-step process. First, you calculate the base Section 382 limitation, which is the value of the company—subject to certain adjustments—multiplied by applicable federal rate. Then you determine whether the company has an overall net unrealized built-in gain (NUBIG) in the company’s assets as of the date of the ownership change. If so, you then calculate the potential increase to the base Section 382 limitation pursuant to Notice 2003-65.

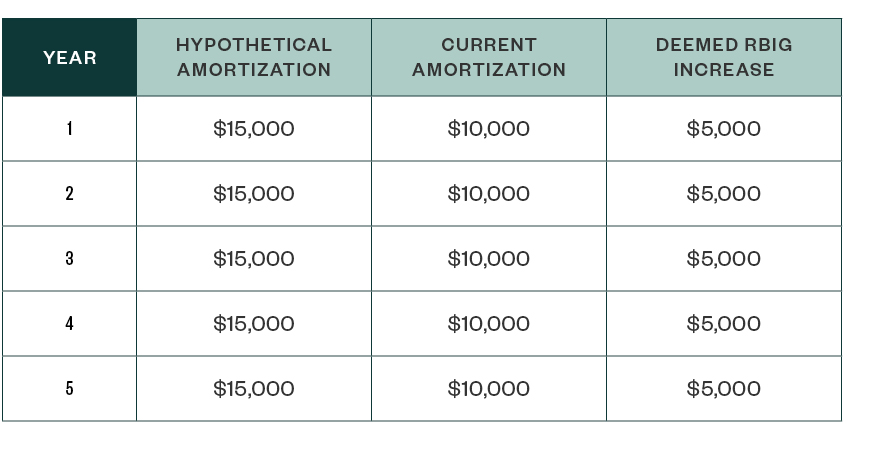

When using the Section 338 approach as provided in the Notice 2003-65, the calculation compares the hypothetical additional depreciation or amortization the company would get if the company was allowed to step-up the basis of its assets to fair market value (FMV) on the date of the ownership change compared to what the company is currently allowed for each year in the five-year period following the ownership change.

Example

Company A experiences an ownership change and it’s determined that it has a NUBIG in its assets, including Section 197 intangible assets that it acquired five years ago for $150,000 that are now worth $225,000. Company A took $10,000 of amortization deductions each year since it was acquired that now has a basis of $100,000.

Pursuant to Notice 2003-65, if company A hypothetically was allowed to step-up its tax basis to the $225,000 FMV, the company would get $15,000 of amortization per year ($225,000/15 = $15,000).

The deemed recognized built-in gain (RBIG) increase to the base Section 382 limitation isn’t $15,000, but rather only $5,000 that’s attributable to the built-in gain portion of the assets after comparing it to the amortization the company was already currently receiving.

This analysis becomes more complicated, however, when a company has material fixed assets with built-in gains. The fixed assets have all sorts of different class lives and typically use accelerated depreciation, unlike Section 197 intangible assets.

When determining the hypothetical depreciation for the fixed assets if the tax bases were stepped up to fair market value, you apply the accelerated depreciation rules to this hypothetical determination. However, according to Notice 2018-30, you don’t include the bonus depreciation rules to calculate the amount of hypothetical depreciation deductions via Notice 2003-65.

ASC 730 Directive Safe Harbor

The new ASC 730 Directive Safe Harbor provides a method for taxpayers to determine qualified research expenses (QREs) and resulting credits that will not be challenged by the IRS on examination.

These financial statements must show the amount of the currently expensed ASC 730 financial statement R&D as a separate line item on the income statement or a separately stated note. Learn more in our Insight.

State Tax Updates

Following are the most significant changes to state tax law during the second quarter of 2018.

California Income and Franchise Tax

On May 18, 2018, California held an interested parties meeting (IPM) where it received comments from the public regarding proposed language changes to California’s income tax apportionment regulations for sales other than sales of tangible personal property. These are the regulations that provide guidance for determining whether receipts from services or intangibles are treated as California receipts in applying California’s Single Sales Factor Apportionment Formula.

The first IPM relating to these regulations occurred in January 2017, and the FTB indicated at the most recent meeting in May that it expects to have at least one more IPM related to these regulations.

California Employee Classification

The California Supreme Court issued a decision at the end of April 2018 that simplified the analysis for determining independent contractor status, but made it far more challenging to do so.

It replaces the old Borello tests with three requirements the hiring business must prove.

Requirements

The worker must be all of the following:

- Free from the control and direction of the business for performance of work

- Performing work outside the usual course of the hiring entity’s business

- Customarily engaged in an independently established trade or business

Learn more in our Alert.

Idaho Sales and Use Tax

The governor of Idaho signed into law HB 578, New Click-Through Nexus Provisions, which take effect July 1, 2018. A retailer is presumed to have established nexus in Idaho if the retailer enters into an agreement with one or more persons engaged in business in Idaho, and such person(s) receive(s) commission or other consideration for having referred potential customers to the retailer.

The rebuttable presumption applies when the cumulative gross receipts from such sales are greater than $10,000 during the immediately preceding twelve months.

Arizona Income and Franchise Tax

Effective for years beginning from or after December 31, 2019, sales receipts derived from credit card receivables—including fees, merchant discounts, interchanges, interest and related revenue—are now included for purposes of determining if a multistate service provider passes an 85% test, which requires that 85% of such taxpayer’s receipts are from purchasers who receive the benefit of the taxpayer’s services outside the state of Arizona.

Passing the 85% test makes a service provider eligible to elect to apply market-based sourcing, rather than cost of performance sourcing.

Indiana Sales and Use Tax

Effective July 1, 2018, new Indiana law exempts software as a service (SaaS) transactions from Indiana’s sales and use tax. Current guidance from the state treats such transactions as subject to sales tax because it treated SaaS transactions as sales of prewritten software. However, the new law overrides that guidance.

We’re Here to Help

Moss Adams continuously reviews the regulatory and tax landscape for technology, life sciences, and communications and media companies. For more information about any of the issues discussed above or for insight on how they may impact your business, contact your Moss Adams professional.